Consider these points before you Draft your LLP Agreement

The LLP Agreement is one such written contract that lays out the rights, responsibilities, and commitments of the parties and controls the operation of the LLP. There is no unique LLP arrangement format. However, the LLP Act (Limited Liability Partnership Act, 2008) provided that in the event of the absence of any arrangement between the parties or the absence of any provision in the agreement on any subject, the First Schedule of the Act must prevail.

Consider these points before you Draft your LLP Agreement

Introduction

Any Business Contract or Partnership should be protected by way of a formal arrangement that sets out the essence of the relationship between the parties to the agreement and which allows for the means to address the different problems that might occur in the course of the transactions. In the case of the LLP, the LLP Agreement is one such written contract that lays out the rights, responsibilities, and commitments of the parties and controls the operation of the LLP. There is no unique LLP arrangement format. However, the LLP Act (Limited Liability Partnership Act, 2008) provided that in the event of the absence of any arrangement between the parties or the absence of any provision in the agreement on any subject, the First Schedule of the Act must prevail.

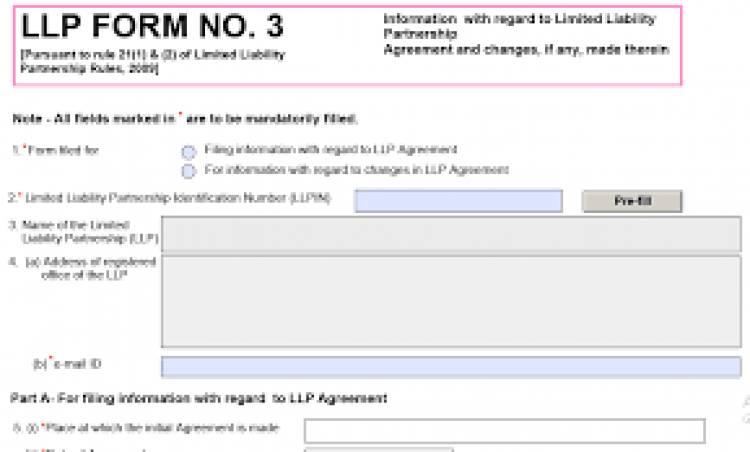

Create an Agreement with your LLP

Form 3, as stipulated in the LLP Regulations, is a suitable guide text for the planning of the LLP Agreement. In fact, you will need to note the specific conditions of the LLP Agreement in Form 3. It is also advisable that, when drafting the LLP agreement, ensure that the clauses are in the same order as that required in Form 3. Again, Form 3 is broad and includes a variety of areas, including Money, Contribution, Rights & Obligations, Dissolution, etc. However, there are some important provisions relating to the LLP Arrangement which are not specified in Form 3.

Key Factors

-

Definition Clause- Like any good agreement, the definition clause aims to provide a shared interpretation of the words used in the LLP agreement. The description clause for separate words should also be included in the LLP agreement. E.g. – concept of LLP capital

-

Partner Contribution- Although this is shown in Type 3 below, there are detailed points that can be applied to the arrangement –

-

The cumulative contribution of the LLP and the contribution of each partner.

-

If a Partner contributes in a non-monetary way, that is, he/she will offer services instead of a monetary donation, add the same.

-

The Percentage of each partner's commitment.

-

Additional capital contribution by the partner in the course of the arrangement.

-

The manner in which the donation can be withheld by the partners – if it may be removed in part, in full, with or without the consent of the partners, etc.

-

Voting Rights of Partners- In addition to the different rights and duties of partners, make sure that the voting rights of each partner are stated in the resolutions adopted at meetings. Include if the President gets a casting vote in the event of a fair vote.

-

Restrictions on the Operations of the Partners- Make sure to mention the terms and conditions applicable to the Partners if they plan to venture into any other company that may or may not overlap with the current LLP business.

-

Acts, Matters, or Items that can only be done with the Agreement of the Partners – Issues on which decisions can be made either by passing a circular resolution or by calling a meeting of the partners. Matters requiring the permission of both partners and requiring the consent of the majority of partners

-

Procedure for any Changes in the Partners- Changes in the partners could be due to the admission of the new partner, departure, retirement, elimination, and death of the partner. Make sure you have the clauses on

-

Eligibility to become a partner

-

Percentage shifts in benefit and expense sharing

-

Changes in contribution percentage

-

In the case of Death of a Partner: what happens to the LLP if there are just two partners and one partner passes away. The relation is also made to the rules on the care of the donation of the deceased spouse, whether the legal heir will become a partner of LLP, the obligations of the legal heirs of the deceased partner, etc.

-

Salary or Remuneration of the Partners- If the partners/designated partners receive the salary/remuneration of the LLP, the same should be clearly specified in the arrangement, along with the number or percentage. Company Income Treatment-If any aspect of the revenue earned by LLP is earned,

-

Set aside for investment or

-

Invested or invested

-

Distributed between the partners,

The same thing should be listed in the agreement. To be more precise, list the avenues in which the surplus sum will be spent. E.g. – 30% of the profits would be deposited in liquid mutual funds.

-

Borrowing Capital from LLP – Note how the LLP will borrow money – whether from strangers or from current partners. If the partners are able to lend to LLP, show the terms for interest on the loan, redemption of the loan, etc.

-

Loan to Partner(s)- Note if LLP will lend a loan to the partner. Decide the limitations on the issuing of loans, the interest to be compensated, if any, the maturity of the loan, etc.

How do you make the LLP Deal acceptable?

-

The task of Stamp: The LLP Arrangement shall be written on the stamp of the State concerned where the registered office of the LLP is based. The option to stamp paper is to pay stamp duty through a bank channel known as Franking. The amount of the stamp duty payable under the State Stamp Act and the stamp duty shall be assessed by reference to the capital added in the LLP.

-

The Consensus of the Partners: The approval of all partners, including the designated LLP partners, is required to make the Agreement binding. The same shall be given by means of a signature by all the parties at the close of the Arrangement. In addition, the partners shall make their initials visible on all pages of the Document in order to prevent any modification to any provision in a dishonest manner.

-

Witnesses: Signatures by at least two witnesses are necessary to make the arrangement legal and enforceable. In addition to the signature, the name and address of the witnesses shall be hand-written by the witness himself. Any person other than the parties to the arrangement could be a spouse or an acquaintance of any sort.

-

Day and Location of the Agreement: The date on which the LLP Agreement is concluded shall be given, along with the position of the jurisdiction where the Agreement is concluded.

What are the Clauses of Must?

The arrangement is rendered by a mixture of different provisions, as set out in the Act, which clarifies and helps to define the intent of the parties to the agreement. A few of the required clauses are listed below:

-

Definition of the Parties;

-

Definitions of the words used in the Agreement

-

Name and Article Clause

-

Office Place

-

Resource Contribution and Profit/Loss Share by Partners

-

The clause on remuneration and other concern

-

LLP Financial Policy and LLP Administration

-

Mutual rights and obligations of couples

-

Restriction on the competitive market

-

Adding or Naming a Partner

-

Resignation and dissolution of the Partner

-

Winding up the LLP

-

Clause of Arbitration

-

Clause of authority

In addition to the aforementioned, some provisions can be attached to the Arrangement dealing with the particular conditions of the LLP and the Partners. It must be borne in mind, however that the provisions inserted do not infringe any section of the Act and the laws or regulations made thereunder. Furthermore, the provisions of the LLP Act and the laws or regulations made thereunder shall still prevail over the provisions of the LLP Arrangement. The LLP Arrangement shall be registered with the MCA by means of the LLP Form 3 within 30 days of receipt of the LLP Certificate of Incorporation. If any amendments are to be made in the future, the changes to the MCA shall be intimated within 30 days. The LLP Act, 2008, in which the LLP is licensed, allows the parties to enter into an arrangement that covers both the organization and the parties to the agreement.

BY –

Kosha Doshi