State-wise rates of Stamp Duty on LLP Agreement

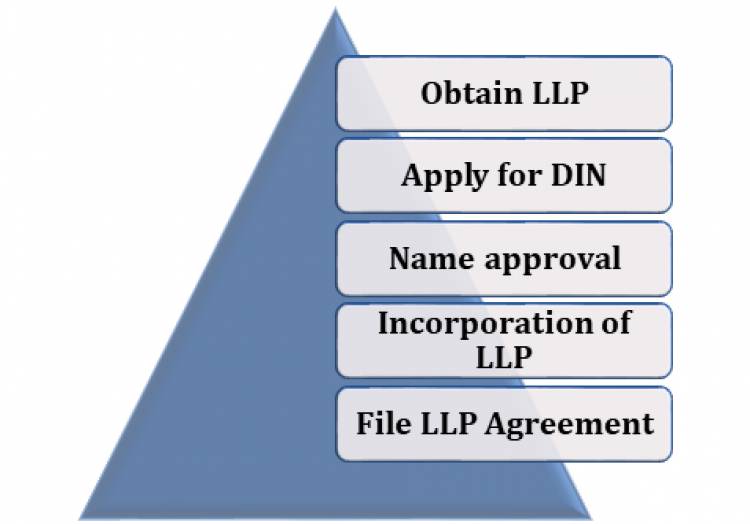

Limited Liability Partnerships are sometimes referred to as LLP in their abbreviated form. LLP was introduced in 2000 under the Partnerships Act 2000 to include joint liability partnerships formerly open only to businesses. LLP is common where a 'technical relationship' would like to benefit from covered liability. LLP's can be acceptable if the partners are members of the institute or if individual profits are specifically specified and not merely applied to a single pot and allocated by the dividend. In the LLP, the profits of the participants are generally used as personal income.

State-wise rates of Stamp Duty on LLP Agreement

LLP Agreement

Limited Liability Partnerships are sometimes referred to as LLP in their abbreviated form. LLP was introduced in 2000 under the Partnerships Act 2000 to include joint liability partnerships formerly open only to businesses. LLP is common where a 'technical relationship' would like to benefit from covered liability. This is especially appropriate for accountants, attorneys, engineers, contractors, surveyors, and other areas of expertise where collaboration is preferred over a limited corporation. LLP's can be acceptable if the partners are members of the institute or if individual profits are specifically specified and not merely applied to a single pot and allocated by the dividend. In the LLP, the profits of the participants are generally used as personal income.

What is used in the LLP Agreement?

-

Contribution by Associates

-

The benefit share ratio for measuring the earnings of the participants.

-

Information on the acceptance process for the new partner.

-

Information explaining the clause relating to retirement and dissolution of a partner.

-

Requirements with respect to the company's reaction to the partner's death.

-

Laws on the dissolution of the company partner.

-

The responsibilities and rights of the parties.

-

Disposal and Power of Assigned Partners.

-

Designation & Remuneration for the Assigned Partners.

-

LLP's seal, and the specifics of how the LLP will come to an end.

Advantages of LLP

-

Restricted liability covers the personal properties of the member against the obligations of the company. The LLP's are members of a separate legal entity.

-

Flexibility, guy. The activity of the relationship and the sharing of benefits shall be decided by written arrangement between the parties. This can contribute to greater versatility in the management of the company.

-

The LLP is known to be a legitimate citizen. It can purchase, hire, lease, own land, hire workers, enter into contracts and if necessary, be held liable.

-

Corporate control of the firm. The LLP may designate two companies as members of the LLP. At least one director must be an actual individual in an LTD corporation.

-

Designated and non-designated participants. You may use the LLP with various membership tiers.

-

Protecting the identity of the relationship. By registering the LLP in the Companies Building, you prohibit any partnership or business from registering the same name.

Disadvantages of LLP

-

Public transparency is the biggest downside of the LLP. Financial accounts must be sent to the Companies House for public record. The accounts may declare the profits of members who may not wish to be made public.

-

Revenue is personal income that is charged accordingly. There may be tax benefits to registering as a corporation, but this would depend on personal circumstances.

-

The benefit cannot be preserved in the same manner as a limited corporation. This means that all profit gained is efficiently allocated without the flexibility to carry back profit for a potential tax year.

-

The LLP shall have at least two members. If a person decides to leave the relationship, the LLP will have to be disbanded.

-

Residential addresses have traditionally been registered at the Companies Building. Although the use of 'service addresses' today enables home addresses to be kept out of public view, any address formerly given to Companies House is now part of the public record until you pay for the records to be erased. This is not a concern for many corporations. There are, however, certain cases where this could not be needed. Remember attorneys and associates in law firms who do not want to make their home address too readily accessible as their practice includes confidential cases.

Stamp Duty on LLP Agreement

LLP deed is a vital aspect of the process of incorporation and cannot be ignored. Pursuant to Section 23 of the Limited Liability Partnership Act, it is mandatory to register an LLP partnership with the Registrar in e Form three within thirty days of its incorporation. The claimant must take the printing of the LLP application on the stamp paper. As a legal record, the LLP arrangement must be written on stamp paper. It should be remembered that this is a mandatory provision as provided for by the respective authority. The applicability of Stamp Duty to the LLP arrangement is dependent on the condition of incorporation and the capital commitment of the parties.

|

STATE |

Up to Rs. 1 Lakh |

Rs. 1 to Rs. 5 Lakh |

Rs. 5 to Rs. 10 Lakh |

Rs. 10 Lakh and above |

|

Andhra Pradesh |

500 Rs |

500 Rs |

500 Rs |

500 Rs |

|

Arunachal Pradesh |

100 Rs |

100 Rs |

100 Rs |

100 Rs |

|

Assam |

100 Rs |

100 Rs |

100 Rs |

100 Rs |

|

Bihar |

2500 Rs |

5000 Rs |

5000 Rs |

5000 Rs |

|

Chhattisgarh |

2000 Rs |

2000 to 5000 Rs |

5000 Rs |

5000 Rs |

|

Delhi |

1% of Capital |

1% of Capital Amount |

1% of Capital (Max: 5000) |

1% of Capital (Max: 5000) |

|

Goa |

150 Rs |

150 Rs |

150 Rs |

150 Rs |

|

Gujarat |

1000 Rs |

2000-5000 Rs |

6000-10000 Rs |

10000 Rs |

|

Haryana |

1000 Rs |

1000 Rs |

1000 Rs |

1000 Rs |

|

Himachal Pradesh |

100 Rs |

100 Rs |

100 Rs |

100 Rs |

|

Jammu and Kashmir |

100 Rs |

100 Rs |

100 Rs |

100 Rs |

|

Jharkhand |

2500 Rs |

5000 Rs |

5000 Rs |

5000 Rs |

|

Karnataka |

1000 Rs |

1000 Rs |

1000 Rs |

1000 + (500 For Every 5 Lakh Increase) |

|

Kerala |

5000 Rs |

5000 Rs |

5000 Rs |

5000 Rs |

|

Madhya Pradesh |

2000 Rs |

2000 to 5000 Rs |

5000 Rs |

5000 Rs |

|

Maharashtra |

1% of Capital (minimum of 500) |

1% of Capital |

1% of Capital |

1% of Capital (15000 Max) |

|

Manipur |

100 Rs |

100 Rs |

100 Rs |

100 Rs |

|

Meghalaya |

100 Rs |

100 Rs |

100 Rs |

100 Rs |

|

Mizoram |

100 Rs |

100 Rs |

100 Rs |

100 Rs |

|

Nagaland |

100 Rs |

100 Rs |

100 Rs |

100 Rs |

|

Orissa |

200 Rs |

200 Rs |

200 Rs |

200 Rs |

|

Punjab |

1000 Rs |

1000 Rs |

1000 Rs |

1000 Rs |

|

Rajasthan |

4000 Rs (50,000 or below: 2000) |

4000 to 10000 (2000 on multiple of Rs. 50000) |

10000 Rs |

10000 Rs |

|

Sikkim |

100 Rs |

100 Rs |

100 Rs |

100 Rs |

|

Tamil Nadu |

300 Rs |

300 Rs |

300 Rs |

300 Rs |

|

Tripura |

100 Rs |

100 Rs |

100 Rs |

100 Rs |

|

Uttar Pradesh |

750 Rs |

750 Rs |

750 Rs |

750 Rs |

|

Uttarakhand |

750 Rs |

750 Rs |

750 Rs |

750 Rs |

|

West Bengal |

150 Rs |

150 Rs |

150 Rs |

150 Rs |

Conclusion

As is evident from the above, the LLP Arrangement is an absolute prerequisite for the implementation of the LLP. The LLP application must not be written on the regular paper; otherwise, the order is canceled by the authority. Instead, the claimant must opt for a non-judicial stamp paper to fulfill the purpose. After these preconditions have been met, don't hesitate to get a non-judicial stamp on the deal. The stamp duty ranges from state to state and depends on the capital contribution of the partner.

BY-

Kosha Doshi