The Importance of Intellectual Property Valuation and Protection

The latest spate of initial public offerings, high-profile mergers and acquisitions, and lawsuits have placed intellectual property (IP) in an extremely important role in the global economy. However many companies also struggle to realize the importance and risks of their IP, even though that IP constitutes a high percentage of the value of the business. With scarce capital and bottom-up demand from customers, businesses need a high rate of return on investment in their intellectual property (IP) and sufficient security. Failure to take steps could pose a significant threat to the success of the company.

Introduction

The latest spate of initial public offerings, high-profile mergers and acquisitions, and lawsuits have placed intellectual property (IP) in an extremely important role in the global economy. However many companies also struggle to realize the importance and risks of their IP, even though that IP constitutes a high percentage of the value of the business. With scarce capital and bottom-up demand from customers, businesses need a high rate of return on investment in their intellectual property (IP) and sufficient security. Failure to take steps could pose a significant threat to the success of the company.

Why Intellectual Property Value?

Changes in the global economic climate have also driven the development of business models, where IP is a core element of value and future growth. In addition to these structural shifts, US. and multinational accounting standards put pressure on companies to identify and value the recognizable intangible properties of a company as part of a sale (in a merger or acquisition, for example).

As a result of these developments, the proper valuation of IP, accompanied by steps to preserve that value, has become a crucial factor in the growth and survival of a modern business. Federal Reserve Chairman Ben Bernanke recently reinforced this idea at the New Building Blocks for Employment and Economic Development meeting, where he addressed the value of intangible resources and that its production has accounted for more than half of the rise in U.S. production per hour over the last few decades.

What are the Variables that affect IP Valuation?

Quality norm – Equal market value and Fair Price Value are the most widely used value principles. This is relevant when performing an IP valuation exercise. Fair market value (Market value) may be defined as the price at which the asset or service moves from a willing seller to a willing purchaser. Both the buyer and the seller are believed to be fair and to have a sound understanding of the relevant evidence. Equal value (fair price) is deemed to be sufficient for the inclusion of the distribution of the post-sale sales price. It is based on the expectations that market players will use to price the commodity. Whereas fair market value tends to be more acceptable when used in the premise of trade value, fair value is also based on the premise of in-use value. In a typical case, IP valuation is a method for determining the fair market value of an IP asset.

Valuation Aim – In order to evaluate the basis for the value estimate, it is important to consider the purpose of the valuation. For e.g, a valuation from a market value and investment viewpoint will be entirely different. In economic contexts, consumer valuation is the correct premise. International Value Principles describe market value as the estimated amount which a property should exchange on the date of valuation between a willing buyer and a willing seller in an arms-length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently, and without compulsion."

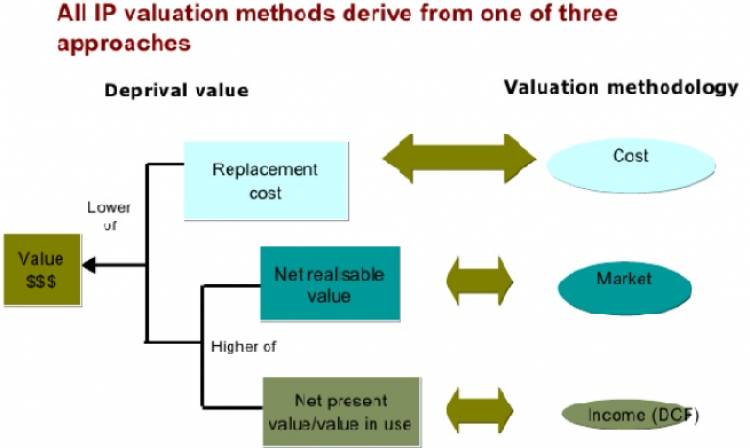

Form of evaluation (s) - The methods used and the conclusions taken when applying a specific valuation approach have an impact on the value of IP properties. Market Approach is the most effective way of valuation. The cost approach is generally avoided by businesses because it lacks the novel features of the IP. This approach is helpful for the costs of R&D.

Character and power of IP properties - The competitive strength of an IP asset is determined by the comparative valuation it has on the market. Factors such as the responsiveness of the client and the delivery on the market of a commodity or availing service shall assess its IP worth. The possibility of new entry and replacements affects the valuation of IP stock.

Why do you need to assess your IP assets?

Licensing and franchise - A thorough knowledge of the IP properties ensure informed negotiating and decision-making of the terms and conditions at the time of licensing-in or licensing-out of the IP, in particular with a view to setting fair and robust royalty rates. In the case of franchising too, both the franchisor and the franchisor need a detailed knowledge of the meaning of the trademark(s) and the trade secrets and the know-how of other IP properties. Examples: Mc Donald's, Pizza Hut, Dominos, Haldiram, Bikanerwala.

Merger & Takeover, Joint Venture or Corporate Partnership - The primary justification for considering an M&A deal is the valuation of the IP properties of the target business. IP valuation allows the parties to take an educated view on the appropriate cost of capital or to settle on the policy of financial leverage to be pursued. It also has a beneficial impact on the value and share price of the resulting business. The approach of world-class corporations such as Volkswagen Group and Tata Group lays out the IP valuation methodology for the adoption of products. The Volkswagen Group owns Audi, Bentley, Skoda, Lamborghini, Buggati, Porsche, and several other well-known brands. The Tata Group is owned by Jaguar and Land Rover.

Investments in research and development (R&D) - IP valuation assists in decisions on budgeting and distribution of capital. For example, if a company spends a large amount of money on internal R&D but is losing ground to rivals due to delayed or late product introductions, it will need to rethink its R&D policy and processes. IP assessment also offers competitive advice for the production of new products, logo extensions, line extensions, international filing and litigation charges, etc.

Economic analysis - The awareness of the share of IP assets in the overall market valuation of corporations has led to a shift in the way the accounting profession has started to treat IP assets in financial statements. The International Accounting Standards Board (IASB) now acknowledges purchased and recognizable intangible assets (i.e. IP assets) and mandates that all acquired IP assets be recognized as assets, apart from goodwill, on the balance sheet of the IP acquisition business. For example, after a brand is purchased, the IP assessment is carried out for the original valuation as well as the annual impairment assessments for the derived values to be used in the balance sheet.

Optimizing taxing - In developing ways of maximizing the tax to be paid by a corporation, its properties, including its IP assets, must be valued. IP assets provide various opportunities for tax avoidance in both third party deals as well as internal techniques such as cross-border transfer pricing and centralization of control of IP assets in IP holding firms. The Internal Revenue Service or other tax officials would like to know as much as possible about the justification for the calculation of valuation used to assign part of the purchasing price connected with the sale of a business. Valuation of IP assets allows determining fair transfer rates for the usage of IP assets, including brands, by subsidiary businesses.

Assurance of IP reserves - An entirely new market is opening up for the protection of IP properties with a range of major insurers in developing countries producing products related to the capital valuation of IP assets, in particular trademarks/brands. As far as insurance is concerned, valuation is of the highest significance.

How do you assess the worth of your intellectual property?

The two effective methods of valuation are as follows:

Market-based - This is the most widely used strategy, based on a comparison with the real price charged for a similar IP asset in equivalent circumstances. The estimate would be correct if sufficient information existed about the existence and scope of the rights exchanged, the circumstances of the contract, e.g. the certificate accepted in the conflict resolution process. The procedure is started by the investigation of a suitable market for collecting transaction information on transactions, licensing of the topic IP. The second step is to pick the appropriate comparative units, such as per drawing" "per location" "per customer" and establish a comparative study for units taking into account factors such as profitability, risk, market, business structure, the strength of IP rights, etc.

Form of Income - It rates the IP on the basis of the amount of financial revenue that the IP is supposed to produce. In order to calculate, estimate the sales flow over the remaining productive life of the asset and balance the revenue by the expense of the asset. The probability must be excluded from the sum of profits by using the discount rate or the capitalization rate. The approach is ideally suited for capturing an IP value that produces reliable cash flows. However, the approach does not accept the individual risks associated with an IP asset and incorporates all risks to be adjusted in the discount rate.

For knowing more about valuation, kindly refer to the given video on "Trademark Valuation" -

By –

Kosha Doshi