How do split equity shares between co-founders?

This guide addresses the crucial decision faced by co-founders when determining how to split equity shares in a new business venture. Equity shares signify ownership and influence the distribution of profits and decision-making power. The guide outlines key steps for co-founders to ensure a fair and equitable distribution of ownership, emphasizing the importance of understanding roles, contributions, and expectations. Additionally, it provides insights into the legal aspects of splitting equity shares in India, governed by the Companies Act of 2013 and SEBI regulations. Co-founders are advised to consider company incorporation, shareholding patterns, authorized capital, valuation, shareholders' agreements, and taxation, seeking legal advice to ensure compliance and avoid future disputes.

Introduction:

When starting a new business venture, co-founders must make important decisions that can have significant consequences on the success of their company. One such decision is how to split equity shares between co-founders. Equity shares represent ownership in the company and can determine the distribution of profits and decision-making power. Therefore, co-founders need to approach this decision thoughtfully and with a clear understanding of their respective roles, contributions, and expectations. In this guide, we will outline key steps that co-founders can take to ensure a fair and equitable distribution of ownership.

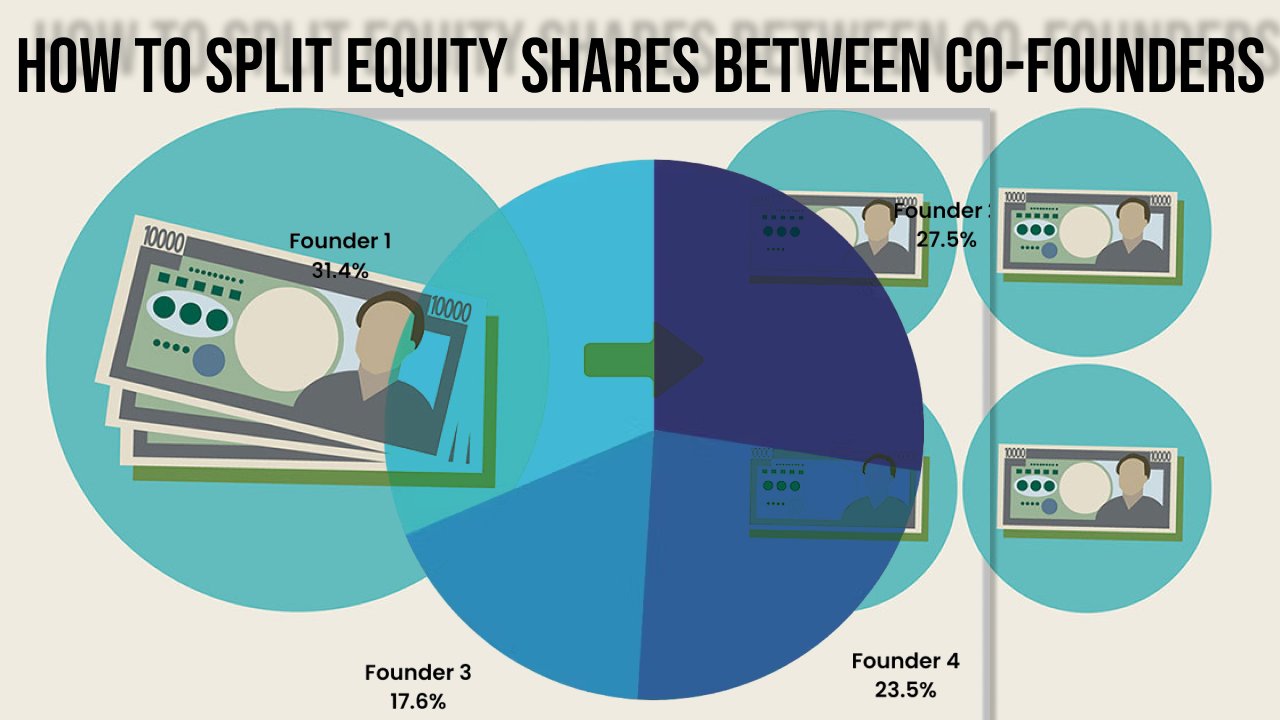

Splitting equity shares between co-founders is a crucial step in forming a startup company. It's important to ensure that each co-founder receives a fair and equitable share of the ownership.

The following are some steps to help you determine the most appropriate way to split equity shares:

- Determine the roles and responsibilities of each co-founder: Each co-founder should have a clear idea of their responsibilities and the value they bring to the company. This will help in determining the equity share each co-founder should receive.

- Consider the contributions of each co-founder: Contributions can be in the form of time, money, or other resources. These contributions should be valued and considered when determining the equity split.

- Discuss and negotiate: Co-founders should have an open and honest conversation about their expectations and goals for the company. This will help in negotiating a fair equity split that everyone agrees upon.

- Consider vesting schedules: A vesting schedule can be put in place to ensure that co-founders earn their equity over time. This can help prevent any co-founder from leaving the company too soon and still owning a large portion of equity.

- Seek legal advice: It's always a good idea to seek legal advice when it comes to equity splits. A lawyer can help in drafting the necessary documents, such as shareholder agreements and stock option plans.

Ultimately, the equity split should reflect each co-founder's contributions and the value they bring to the company. It should be a fair and transparent process to ensure the success of the company in the long run.

Indian law on splitting equity:

In India, the legal aspects of splitting equity shares between co-founders are governed by the Companies Act, of 2013, and the regulations issued by the Securities and Exchange Board of India (SEBI). Here are some key legal aspects that co-founders should consider when splitting equity shares between India:

- Company Incorporation: Co-founders must register their company as a private limited or a limited liability partnership (LLP) under the Companies Act, 2013, to be eligible to issue equity shares.

- Shareholding pattern: The shareholding pattern of the company must comply with the SEBI regulations and the Companies Act, 2013. For example, a private limited company's minimum number of shareholders is two, while an LLP must have at least two designated partners.

- Authorized Capital: Co-founders must decide on the authorized capital of the company, which is the maximum amount of capital that the company can issue.

- Valuation: The equity split must be based on the valuation of the company, which a registered valuer must determine.

- Shareholders' Agreement: A Shareholders' Agreement must be drafted and signed by all co-founders to specify the rights and obligations of each shareholder, including their voting rights, transferability of shares, and vesting schedule.

- Taxation: Co-founders must comply with the tax laws in India, which require them to pay capital gains tax on the sale of equity shares.

Co-founders should seek the guidance of a lawyer or a legal advisor to ensure compliance with the legal aspects of splitting equity shares between co-founders in India.

Conclusion:

Splitting equity shares between co-founders is a critical decision that can impact the success of a startup in the long run. Co-founders must approach this decision thoughtfully, taking into account their roles, contributions, and expectations. Additionally, in India, co-founders must comply with the legal aspects of splitting equity shares, which are governed by the Companies Act, 2013, and regulations issued by the SEBI. The incorporation of the company, shareholding pattern, authorized capital, valuation, shareholders' agreement, and taxation are some key legal aspects that co-founders should consider. Seeking legal advice can be beneficial to ensure compliance with the legal framework and avoid any legal disputes in the future. By following these steps, co-founders can establish a solid foundation for their startup and work towards its success in the long run.