How to Raise Funds for a Start-Up

A start-up is a young company that is founded by an (or more) entrepreneur(s) having a unique business idea or in possession of a unique product or service and expresses his (or their) interest in making a profit by bringing it to market. An entrepreneur is an individual who comes to the market with a new idea, bearing most of the risks and at the same time enjoying most of the rewards.

Introduction

A start-up is a young company that is founded by an (or more) entrepreneur(s) having a unique business idea or in possession of a unique product or service and expresses his (or their) interest in making a profit by bringing it to market. An entrepreneur is an individual who comes to the market with a new idea, bearing most of the risks and at the same time enjoying most of the rewards. Now when an entrepreneur decides to set up a business i.e. a start-up he has to choose a particular business type (sole proprietorship, partnership, corporation, one-person company, etc.).

But no matter what type of business he chooses, he must have the appropriate funding or capital to set up the business. The fund is the lifeblood of any business. Therefore he must consider the following before incorporation of the business—

-

The line of business and requirement of assets to set up such types of business or in simple words, his initial investments

-

The modes of raising funds i.e. by borrow money for this purpose or share the ownership with others by issuing equity

-

Management of the flow of funds in the business i.e. day to day operations of the business, collecting cash from debtors, paying the creditors, maintaining appropriate cash balances so that neither there is excess nor a shortage of liquidity.

-

Repayment of debts to the investor i.e. by way of securities or by way of debentures or any other hybrid instruments.

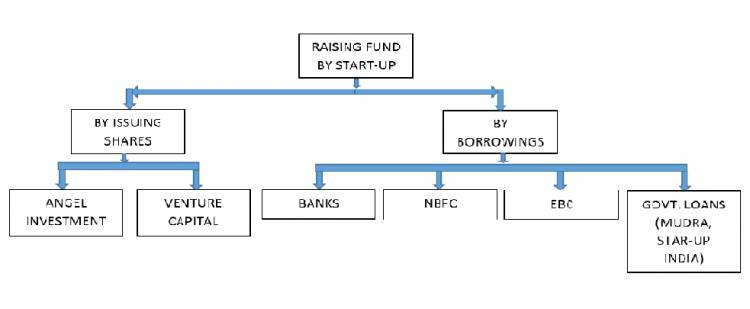

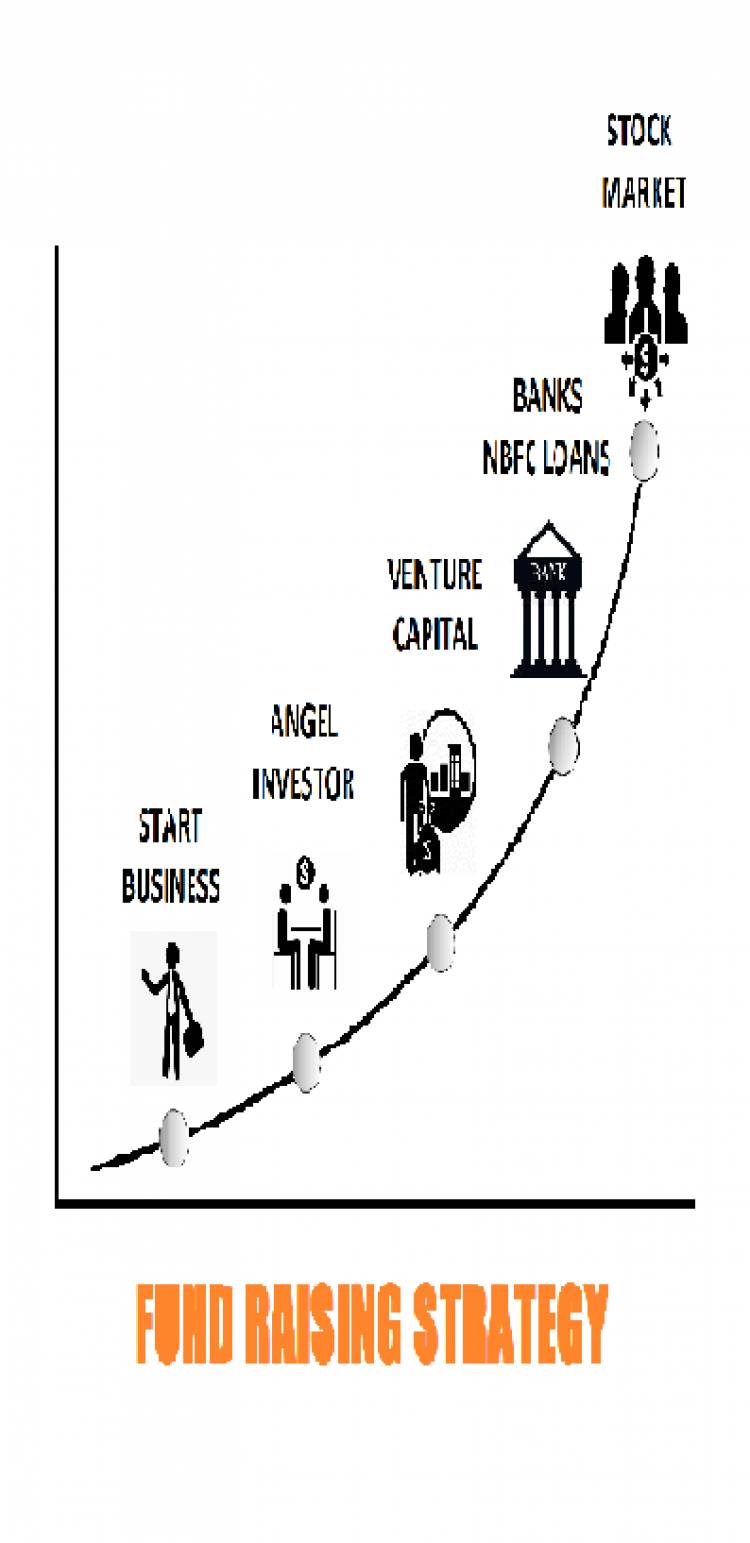

To meet requirements of the capital needs, an entrepreneur generally has two ways to raise the capital—

-

By issuing Equity Shares i.e. ownership shares; and

-

By way of Debt Financing i.e. bonds, debentures, loans etc.

Both of these investments are provided through Alternative Investment Funds (AIFs) which is regulated by the Securities and Exchange Board of India (SEBI) through SEBI (Venture Capital Funds) Regulations, 1996 and SEBI (AIF) Regulations, 2012.

1) Equity Shares

Usually, two types of investors invest in a start-up in return for equity shares. These are—

-

Venture Capitalist, and

-

Angel investors.

They invest in unlisted private companies and take a share of their ownership. This way of raising capital is considered to be safe because the equity shares can be paid off only in the event of liquidation and equity shareholders can be paid dividends only when there are distributable profits i.e. no profit no dividend. So in a way, it is a long-term investment that allows a new business to grow over time. Now let’s take a closer look at the difference between Venture Capitalist and Angel investors—

-

Angel investors are generally high net worth individuals or small-scale corporations who invest their money into the formation of new businesses. Whereas Venture Capitalists are persons or firms that invest in small companies using money pooled from investment companies, large corporations, and pension funds.

-

Generally Venture Capitalist do not invest in the formation of start-ups; rather they invest in start-ups that are already established and capable of generating large profits in the future. Angel Investors in this regard are a more suitable option for an entrepreneur because they are often more willing to take a bigger risk than traditional financing institutes, like banks.

-

Another advantage is, Angel Investors do not expect returns from their investments, unlike Venture capitalists who generally look for a return of five to ten times the original investment. Thus unless the start-up is having the potential to provide a high rate of return on their investments, the entrepreneurs shall refrain from seeking investment from Venture Capital.

One of the major drawbacks of raising fund through Equity Shares is the possibility of losing ownership over the start-up if the entrepreneur gives up the majority of equity shares to the Venture Capitalist or Angel Investors. Therefore it is advised to precisely mention certain clauses in the agreements such as—

-

The number of equity shares the investors will own in that start-up

-

The voting rights held by the investors on the board of the start-up

-

Right of redemption on debentures or preference shares of the start-up

-

Condition precedents of an agreed transaction or conditions subsequent to be completed within the agreed time frame; etc.

In India, the software sector in particular is attracting a lot of venture finance. Apart from software, media, health and pharmaceuticals, agri-business and retailing are some other areas that are favored by the venture capitalists.

2) Debt Financing

Another way of raising capital is by issuing debt instruments such as Loans, debentures, commercial borrowings, etc. Funds raised by debt financing needs to be repaid in installments within a stipulated time and with interest. Debt financing involves collaterals against its investments i.e. the start-up needs to provide security, generally in the form of assets of the company or the promoter or the founders, against the investments.

-

One of the major drawbacks of debt financing because if the start-up fails and is declared bankrupt, the assets can be sold to recover the unpaid amount of the investment. Therefore adequate assets are a prerequisite for debt financing.

-

However, there are advantages as well. As debt financing does not involve ownership shares, the investor does not have a right to decision making in the start-up company. The investor’s role starts and ends with lending and its repayment and their right to interfere in the functioning, operations or business decisions making in the start-up is limited.

Generally, Bank Loans, External Commercial Borrowings (EBC), NBFC loans, certain governmental loan schemes (CGTMSE, MUDRA, Start-up India) are some of the examples of debt financing. These loans generally come with a lot of paperwork and a lot of terms and conditions requiring statements of collaterals, condition precedents, regulatory compliances, and many others.

The rate of success for start-ups was always not up to the expected satisfaction. With the lack of funding and experience in the formulation of business strategies, there is very less guarantee that the start-up business will function as per expectation and will bring profits. Thus, returns from investments are not at all secured unless it is expressly secured in a written document by the financial institutions. Therefore, a start-up should refrain from approaching with a policy of debt financing to raise capital if there is a shortage of adequate assets or is not confident enough that the business would render a high rate of return.

Incubators

Another source of an unconventional mode of financing, which is becoming more and more famous not only in India but also in other jurisdictions as well are Incubators or Incubator Firms. An incubator firm is an organization engaged in the business of nurturing young companies such as start-ups through different developmental phases until the companies become sufficiently financially capable with ample human, and physical resources to function on their own. These types of set-ups precede the seed funding stage and help the entrepreneur to develop a business plan or prototype of the product by providing resources and services in exchange for equity shares or fees for their services.

An incubator firm can be either a non-profit or a profit-making organization that can assist with any or all of the following methods such as:

-

Access to financial services required to start a business

-

Access to experienced business consultants and executives

-

Access to office space and business support

-

Access to IT resources via relationships with governmental or non-governmental institutions

In India, Incubation services are generally availed in government-supported institutes like the IITs, IIMs, NLUs, NITs, prestigious engineering institutes, etc. Apart from that, certain private organizations also provide such services to create a business-friendly environment.

To know more, about How to get funding for your Startups, see the video below -

Conclusion

The growth of a nation’s economy depends on the industrial developments of that nation and Business entities are an inseparable part of the industry. The country’s industry flourishes when the country’s business environment gains the confidence of the investors. Therefore, it is an obligation on the part of the government of that country to create such a favorable environment for the business to grow, and encouraging the formation of start-ups is one way to achieve it. But for a successful start-up business, the constant requirement of funds is the utmost necessity and investors are the major players who can fill that void. The government of India is changing its policies to accommodate every possible opportunity to support our entrepreneurs. Our Prime Minister has already set a goal of achieving a 5 trillion dollar economy by the end of 2024. Only time will tell, how successful we have been in achieving our goal.

BY -

DEBKRIPA BURMAN